How Capacity is creating revolutionary AI for loan origination and processing.

There’s a lot of chatter these days around AI in the mortgage industry and almost all of it is focused on how certain aspects of the mortgage life cycle can be automated. Approval processes, signature and verification procedures, and application reviews are all tasks that can slow down or halt a loan process, and are perfect examples of what can and should be automated.

Entire organizations have sprung up with the intent of taking the pain out of the consumer side of the lending industry. But what if there was a way to help the people who support, underwrite and close loans day in and day out?

If you are a modern-day loan officer, underwriter or in-office support staffer, you’re often working across multiple tools and systems, many of which are outdated and difficult to navigate. Most of the tools aren’t mobile-friendly so if a mortgage team member is in the field, there’s no easy way to get their hands on critical bits of intel like the interest rate for the Jones’ mortgage or the close date of the Herrera loan.

That’s exactly where AI can bring it’s value today.

Just ask Capacity.

Capacity is the first AI-powered team member for the mortgage industry. She makes all of the mortgage information accessible in the simplest possible way.

This is the pain point that Capacity is solving as we speak.

“80 percent of high-performing loan officers ranked the ability to support high loan volumes as a top priority, along with access to technologies and systems that help them scale.”

Floify

Speaking of high-performing loan officers, the top 40 percent of loan officers drive 80 percent of volume in the mortgage industry, and increasing productivity by 25 percent among the top 40 percent of loan officers would increase net revenue by 20 percent.

Put into that perspective, Capacity is a no-brainer.

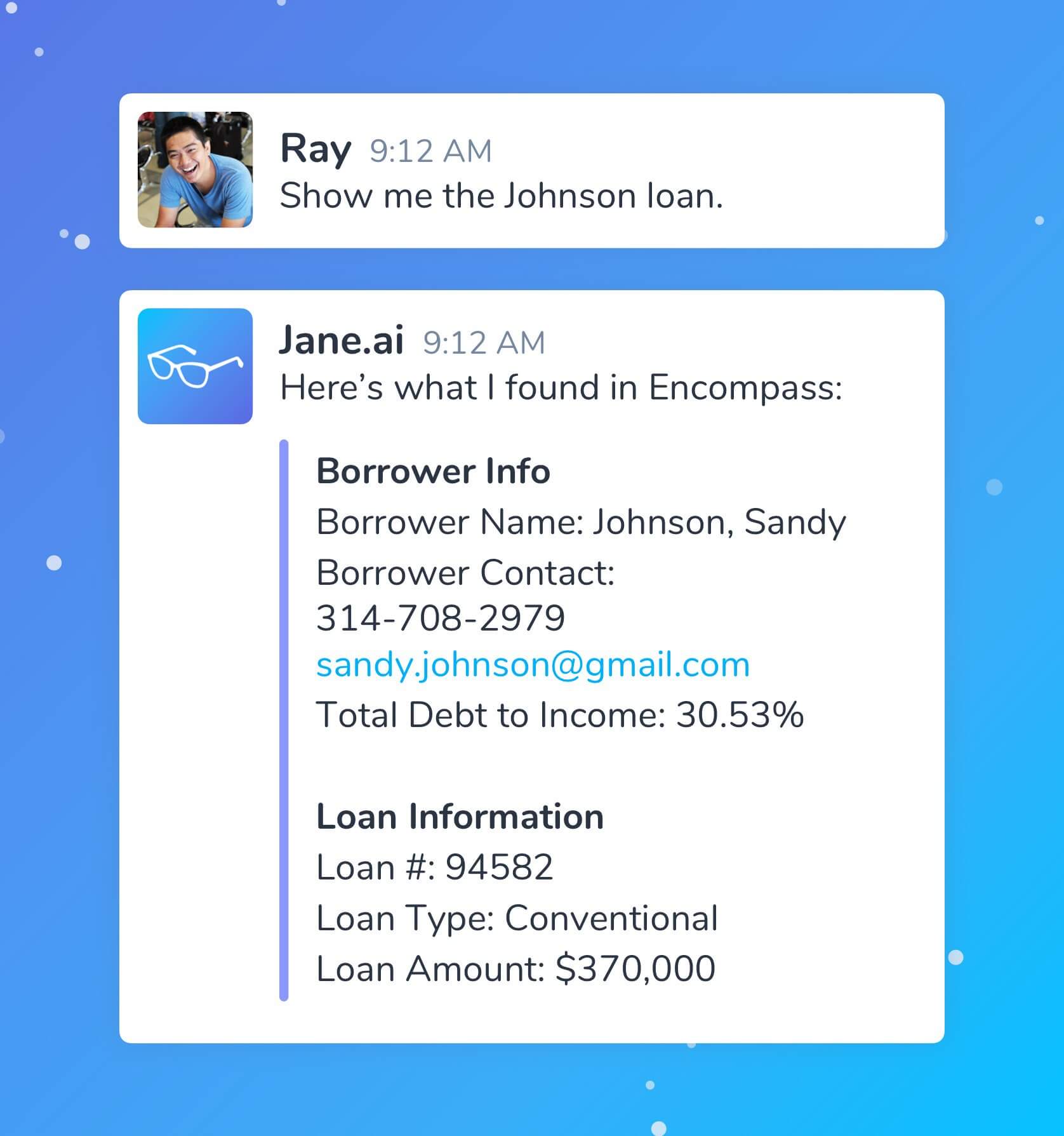

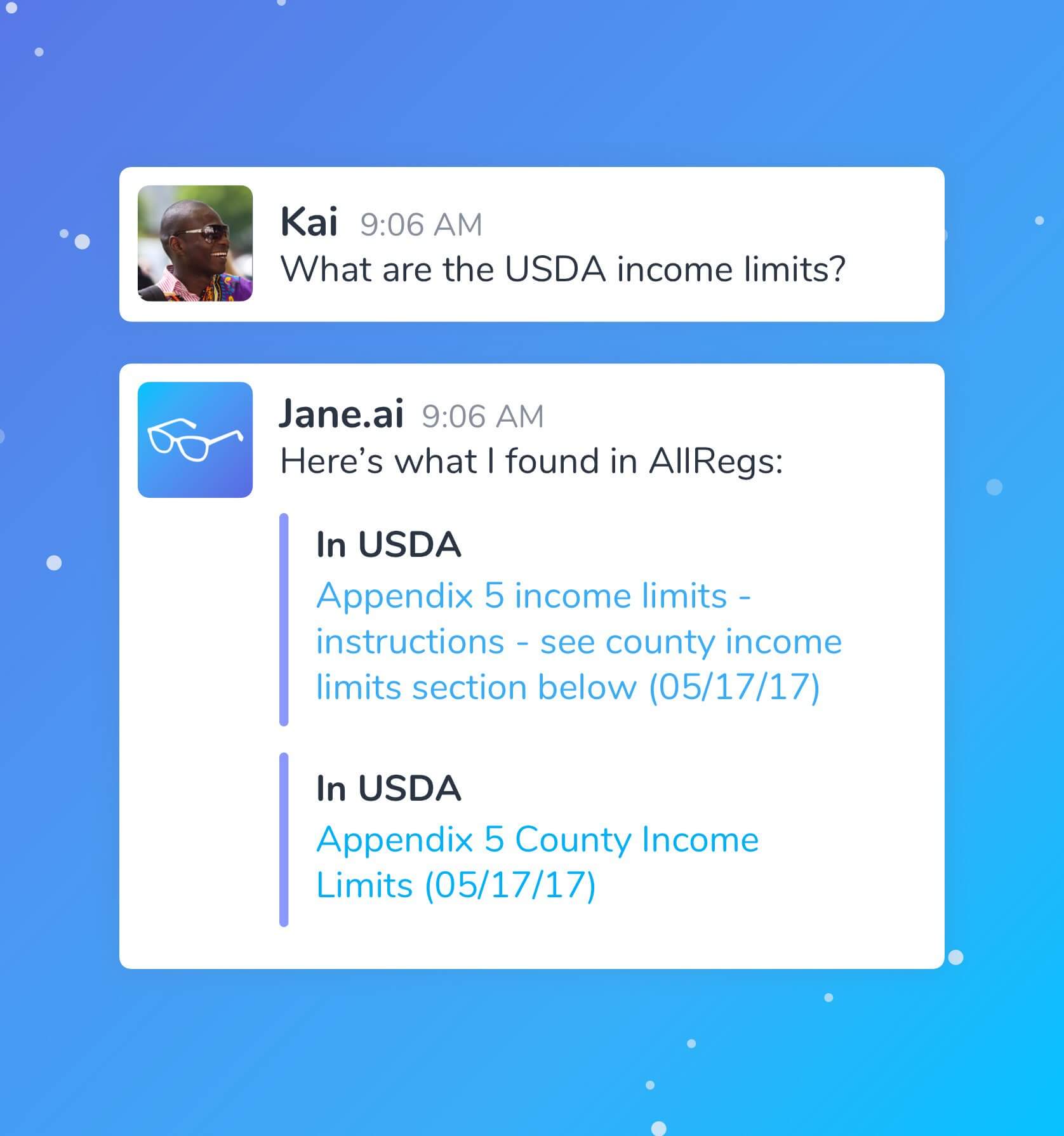

Capacity is integrated with the most mission-critical apps that are integral to the mortgage process. These apps include loan platforms such as Encompass, compliance and regulatory services like AllRegs, and even payroll and benefits systems.

With Capacity, mortgage team members enjoy a single, universal entry point instead of having to log into multiple tools and interfaces, using multiple usernames and passwords. They just ask for whatever it is they’re looking for and Capacity authenticates with the correct system, finds what they asked for, and instantly sends it right back.

I mean, how much easier would your life as a loan officer be if this was your life.

(Before rebranding, Capacity previously did business as Jane.ai.)

It can be, and it already is for the team members at companies like USA Mortgage.

“I have some folks telling me that they’re saving hours a day with Capacity.”

Ron Mueller

SVP of Sales & Marketing, USA Mortgage

Capacity now handles USA Mortgage’s near-constant stream of questions with realtime information, and without the need to log into multiple systems or interrupt multiple people. Just ask Capacity from a chat interface like Slack or Skype, from a website, from a mobile device—whatever your team members are already using to communicate. With no installation necessary and very minimal training, loan officers are quickly up-and-running, reaping the benefits of instant access to all the information they need to close loans faster.

USA Mortgage is also reaping the benefits of loan officer retention. Loan officers, especially top-performing loan officers, manifest a very high turnover rate. The average time a loan officer has been at their company is only 3.1 years, and 56.9 percent of loan officers have been at their company for 2 years or less.

What this means is that as much as 30 percent of an average mortgage company’s pipeline is at risk due to loan officer turnover.

Providing access to easy-to-use technology can help convince top talent to stay.

Capacity helps mortgage team members excel in their jobs, affording the entire organization the ability to focus on what will drive their business forward: generating and nurturing customers, improving the customer journey, shortening transaction windows, and, most importantly, closing more deals.